Annuities And Financial Services

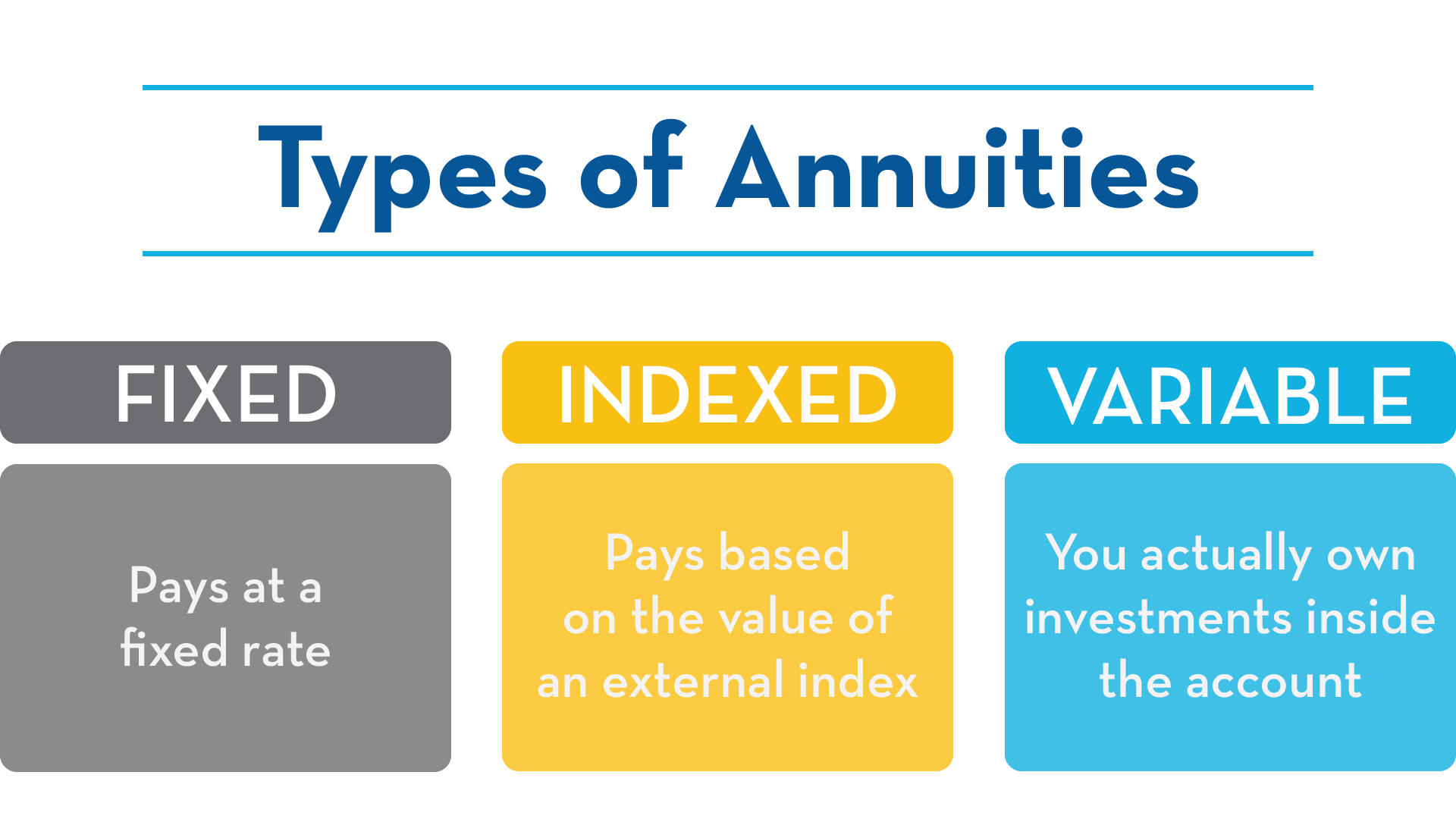

Fixed Annuities, also called MYGAs (Multi-Year Guaranteed Annuities) are the most popular financial vehicle we handle. A MYGA is typically a single lump sum that is invested for 3-6 years. The longer you invest, the higher the interest you are normally able to receive. There are ZERO charges or fees for this type of product. Every penny you invest stays in your account and interest is earned tax free. You are only taxed when you withdraw money from your contract. Most of the time you will have waivers on surrender charges for things such as terminal illness, skilled nursing, and death.

Indexed annuities are a popular product in the financial world, but may not be the best choice for someone who is nearing retirement age or who does not want their money to remain flat. The idea is that the money is tied to an index and if the index preforms well, so will the annuity. Fixed indexed annuities are very complex products and you will tie your money up for a much longer time than the MYGAs. Normal time is 10-14 years. If you start withdrawing before that time is up, you can face stiff penalties and loss of any bonus that may have been promised. Contracts should be closely examined before purchase.

Variable annuities are just what they say - variable. Performance is linked to the stock market and you may earn a good deal of interest OR you may lose a large sum of money. A variable annuity has the ability to generate the most interest of any of the three types discussed here, but you also may lose a tremendous amount if the stock market does poorly. You MUST have a trusted and licensed advisor if you wish to pursue this option.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.